Your monthly update on the state of the pork, poultry, beef, and seafood industries, direct from the category experts at Y. Hata.

Grocery

Chili Pepper Shortage – Huy Fong Foods – manufacturer of Sriracha Hot Chili Sauce, Sambal Oelek and Chili Garlic Sauce has suspended production until Sept 2022. Unfavorable Weather has caused a shortage of Chili. Chili Peppers usually require mild weather to grow, with ideal temperatures between 60 to 80 degrees Fahrenheit.

Tomatoes – Overall crop looks good. All categories (Conventional, San Marzano Styles and Organics) have a positive outlook and yield.

Peaches – Organic Peaches began Harvest on 6/3/2022. Crop yields are expected to be good. Conventional Peaches on the other hand will have less than expected yield. Two frost events earlier in the year greatly impacted available fruit count. Farmers expect 16.5% less tonnage than originally estimated for 2022.

Pears – Crops in the California region are progressing nicely. The quality in all districts looks good and overall tonnage looks ideal for this year’s harvest needs. In the Pacific North West region, estimated tonnage is down 23% than desired amount for this year’s harvest.

Poultry

For months now we’ve talked about higher input cost for manufacturers and processors and that continues – but the pace has increased. Specifically, the rate of increase in labor, energy, fuel, and feed cost is higher than many had anticipated. Combine that with a reduced labor force and strong domestic and export demand, we’ve recently seen the highest prices on record for many chicken and turkey parts. It is still a challenge to purchase certain parts. Here is an overview of them.

- BI Thighs– All packs of BI Thighs are difficult to uncover and even the once plentiful 40 lbs. bulk pack is limited. Processors would rather bone out the Thighs and sell BL SL Thighs which is more profitable.

- BL SL Thigh – Supply has improved, and prices have stabilized but we are still looking at an all-time high.

- Legmeat – Legmeat has started that upward price trajectory and like all dark meat are supported at higher price points.

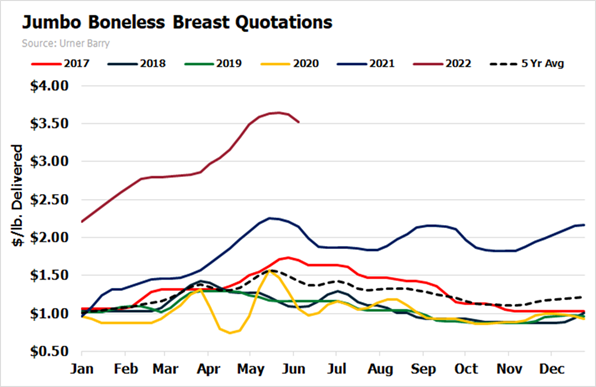

- Breastmeat – As everyone is aware the breast market reached an all-time high recently and this chart illustrates that increase when compared to previous years. Also note the rate of increase starting in January to June 2022. We are starting to see the effects of that increase as retailers are turning to pork as their featured protein for their ads.

- Wings – The market, which was flooded with domestic and imported wings, has stabilized but still are at very attractive prices when compared to the past 2 years.

- Turkey – The Turkey industry also is confronted with higher input cost, but they have been harder hit by the Highly Pathogenic Avian Influenza (HPAI) which has resulted in bird losses and delayed future production. Combine that with strong demand and we can expect price increases shortly. Suppliers have notified their customers they are allocating products and as of now do not have a recovery date.

Pork

The pork industry still faces the challenges of higher fuel, energy, transportation, labor, and feed cost, yet the prices have been relatively stable and availability good. One thing that has changed is the historical price trends of certain items.

One example is Ribs. Prices on Ribs usually go up as we head into the summer but this year, they have taken the opposite approach. Same with Boneless Butts. This could quickly change but it presents a challenge for Buyers on how to position their inventory for out-front buying.

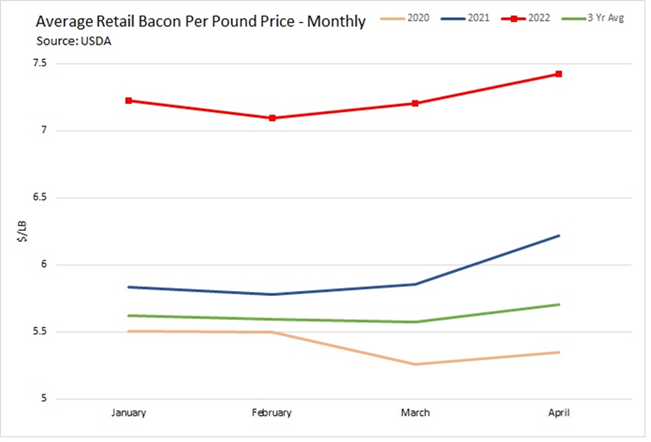

Prices on Bacon have been increasing and one of the key drivers is the retail demand. This chart illustrates the average retail price of Bacon in 2022 compared to previous years and it certainly has been elevated.

Pork & Poultry Market Overview

The widespread nature and height of inflation is cause for many consumers to change their spending habits at the retail and Foodservice level which will impact prices and availability for Y. Hata’s customers.

Chicken Breast has been the dominant item in retail ads for months but with the dramatic price increases retailers are now turning to pork as their featured item. This means we will probably see an increase in pork prices soon, i.e., butts, loins, ribs. We could also see an opposite effect on Chicken Breast where the prices start to decrease.

As processors continue to grapple with labor shortages, we can expect vendors to conduct “SKU Rationalization” more aggressively as one way of becoming more efficient and be able to produce more product to fill the demand.

Further processed/value added items, i.e., Breaded Tenderloins, Grilled/Fajita Breasts, Diced/Pulled, require additional labor and although highly profitable for the processor, the supply will continue to be a challenge. Processors are challenged to fill orders for value added products and continue to struggle.

The protein processors, and more so the poultry industry, are realizing the landscape has changed and they will be challenged to get back the labor force they had pre-pandemic. They will have to look at multiple ways to improve production and efficiency.

Automation is one area the US poultry processors will be investing in to take the place of manual labor. What this means is initially the workmanship of the machines may not be as precise and it will require time to get it perfected.

Beef

Despite the improved labor situation at the plants, the beef industry is still grappling with the effects of the ongoing Russia-Ukraine conflict with higher animal feed, fertilizer, and fuel costs. Additionally, beef demand continues to remain strong both domestically and overseas. With this strong demand, retail pricing for beef has remained at near record highs.

Another critical issue looming in the industry is widespread drought conditions across many parts of the country. We should expect potential supply issues towards the end of 2022 and early 2023. In the face of inflation affecting overall consumer spending, demand continues to remain robust for prime and premium grades (CAB, SS, PSA) regardless of cut.

- Ribeye pricing has been steadily increasing as we approach the summer months. With pricing still at relatively high levels, both retail and foodservice demand has been lukewarm. When prices start to decrease again, we should not expect prices to follow historical seasonal trends as a new bottom will have been established.

- Chuck flat pricing, which has started to increase again, will be decreasing for July primarily due to unseasonable softness in the chuck market. Although this is welcome news, we do not expect this downward trend to continue as these lower prices have already attracted domestic and export buyers. This month the price recently increased by $.11/lbs. but will be decreasing by $.55/lbs. for July.

- Oxtail and short rib pricing continue to decrease from the historically high levels that we were at earlier this year. Let’s hope that this continues as we are still at elevated levels.

The biggest uncertainty for the beef industry is how inflation impacts consumer spending and consumption moving forward.

Seafood

- Snow Crab – The Crab Market is still showing weakness. We have an abundance of 5/8 and 8/up for our customers.

- North-Atlantic Lobster Tails (Cold Water) – The new season has started coming in. Catches are decent and prices have softened compared to last season. You will be seeing decreases across the board from tails to CK Meat. The current season that began in July is predominately for the tails 4/5 oz. and smaller. We will have to wait for the Fall Season that begins in September, which usually produces the larger sizes.

- Mahi – The Taiwan season is still not looking good. So far, there is not many fish coming in, and what is being caught is on the smaller size. They have passed 2/3’s of the season and will be lucky if they catch 40% of last year’s total. In the next 2 months, anticipate 4 oz. portions to go up by $0.30/lbs. Right now, fillets, 2-4 oz. and 6 oz. portions, are holding steady but that could change as time goes on.

- Ono (Wahoo)– This fish shares the same season as Taiwan Mahi. The same boats that are fishing for Mahi, are also fishing for Ono. They are also having the same result as the Mahi; catches are significantly down. Ono is currently in short supply and prices are steadily rising. Prices are already up $0.20/lbs., with anticipated increases later in the year of $0.35-0.55/lbs.